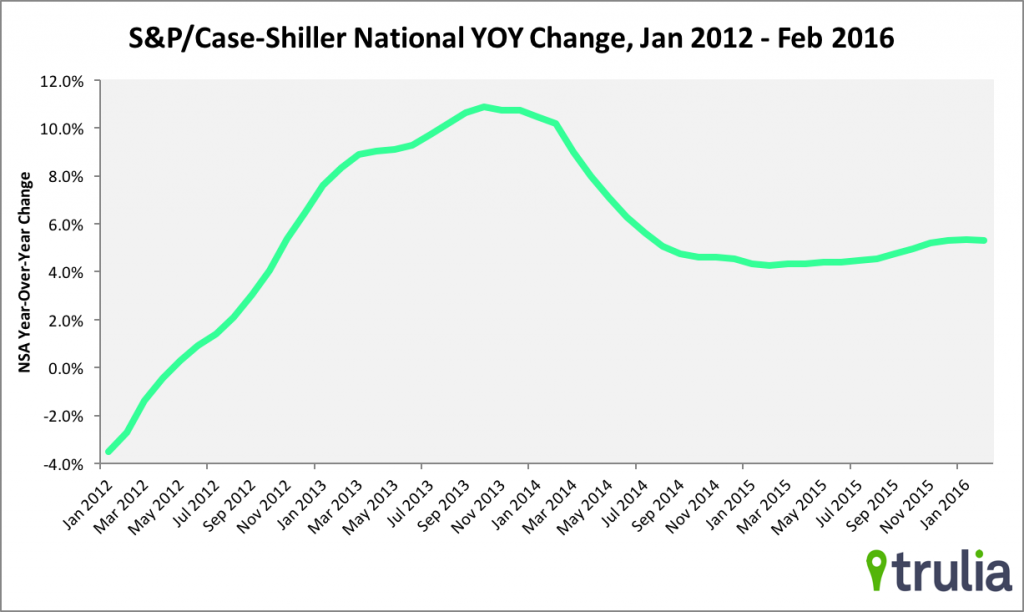

The S&P/Case-Shiller National Home Price Index suggests the U.S housing market may be stabilizing as the rate of annual price growth slowed slightly in February of 2016. Coastal markets in the West and South led the charge.

Today’s S&P/Case-Shiller National Home Price Index increased 5.3% year-over-year in February 2016, which is the 46th consecutive month of positive gains. February also breaks a 10-month streak where ninth in which the year-over-year figure increased over the previous month. While one month does not make a trend, this is a sign that the US housing market may be stabilizing in the wake of strong price appreciation between 2012 and 2014. While the S&P/Case-Shiller National Home Price Index is an important metric to watch, it’s worth noting that the measure is more reflective of price movements in premium homes rather than middle or lower tier homes.

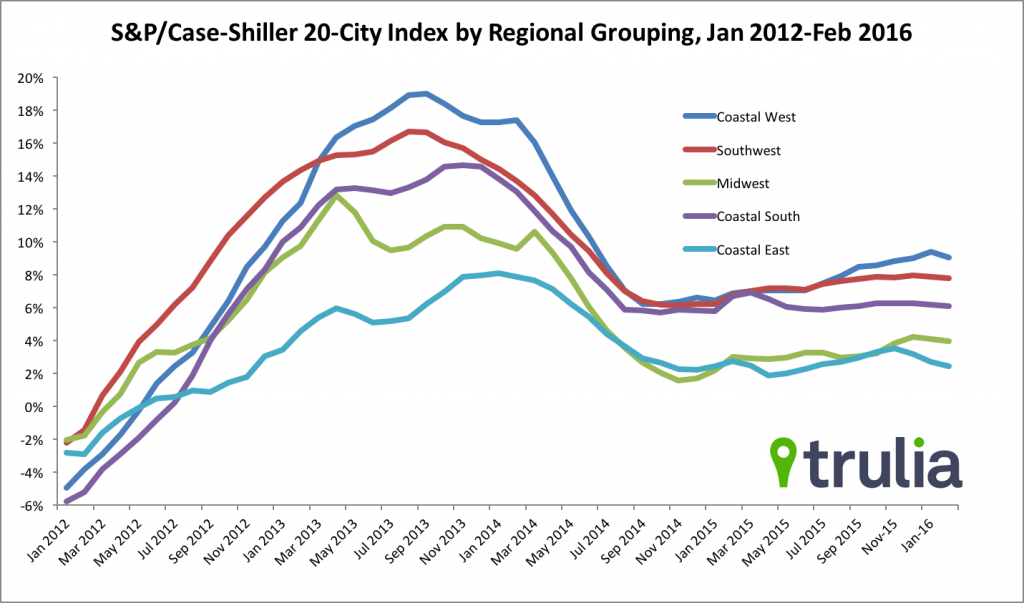

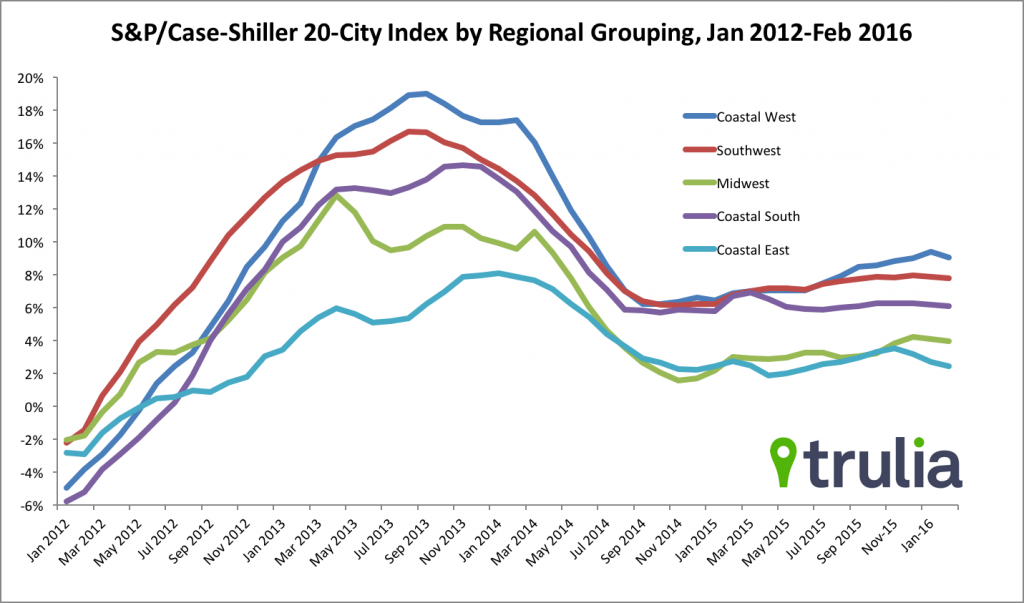

Prices in last month’s three hot markets – Seattle, San Francisco, and Portland – continue to surge year-over-year with increases of between 9.2% to 11%. However, this month Denver replaces San Francisco in the top three with an increase of 9.7% Higher prices in these markets should help increase inventory headed this Spring, but at the same time push some homes out of reach for buyers. Prices in the coastal West, Southwest, and coastal South led the way with year-over-year averages of 9.1%, 7.8%, and 6.1%, but price increases in the cities are down slightly from the end of 2015. Prices in the Midwest and coastal North lagged, showing smaller gains of 4% and 2.4%. This suggests the price gap between coastal, temperate regions of the country and more inland, northeasterly markets is remaining flat.

S&P/Case-Shiller Highlights:

- The US National index for February 2016 was up 5.3% year-over-year.

- The three cities with the largest year-over-year gains were Portland, Seattle, and Denver, with gains of 11.9%, 11%, and 9.7%

- The price gap between coastal, temperate regions of the country and more inland, northeasterly markets is remaining flat.