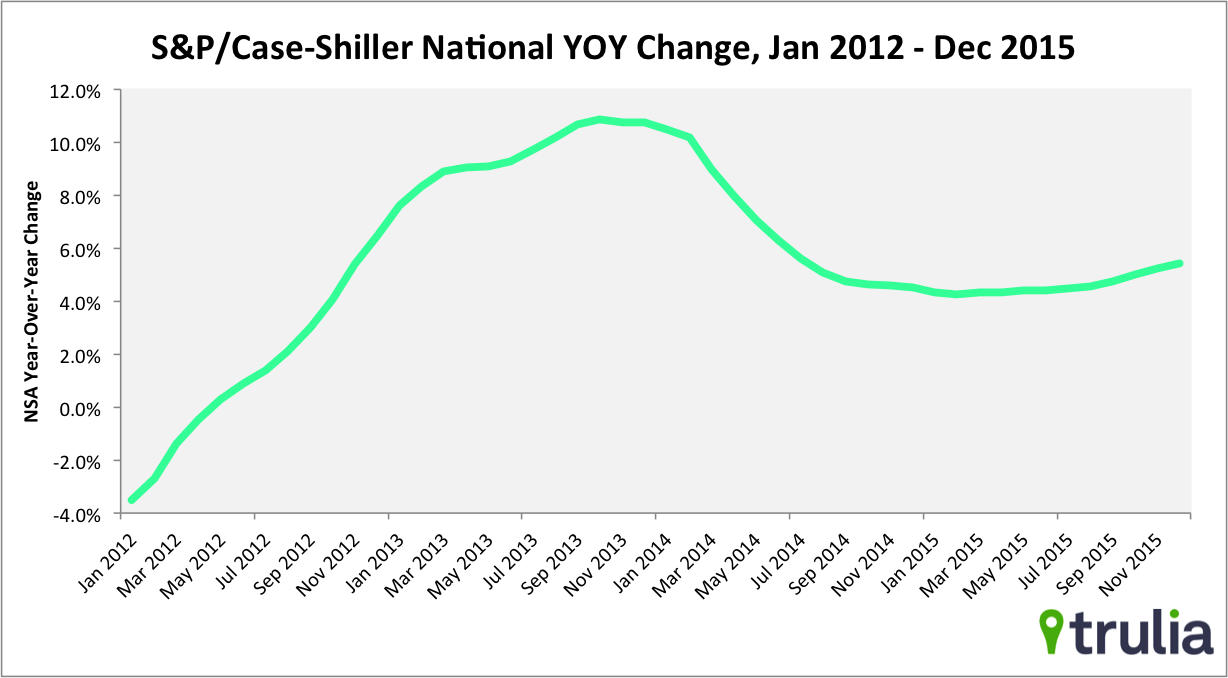

Today’s flurry of reports suggests the housing market recovery continues to charge ahead despite concern over global economic conditions, although homebuyers could be getting nervous. The S&P/Case-Shiller National Home Price Index increased 5.4% year-over-year in December 2015, which is the 44th consecutive month of positive gains. More importantly, November’s number was the 10th consecutive month in which the year-over-year figure increased from the previous month. This continued upward trend of the National Index reflects low unemployment, strong job growth, low inventory, and generally positive consumer sentiment.

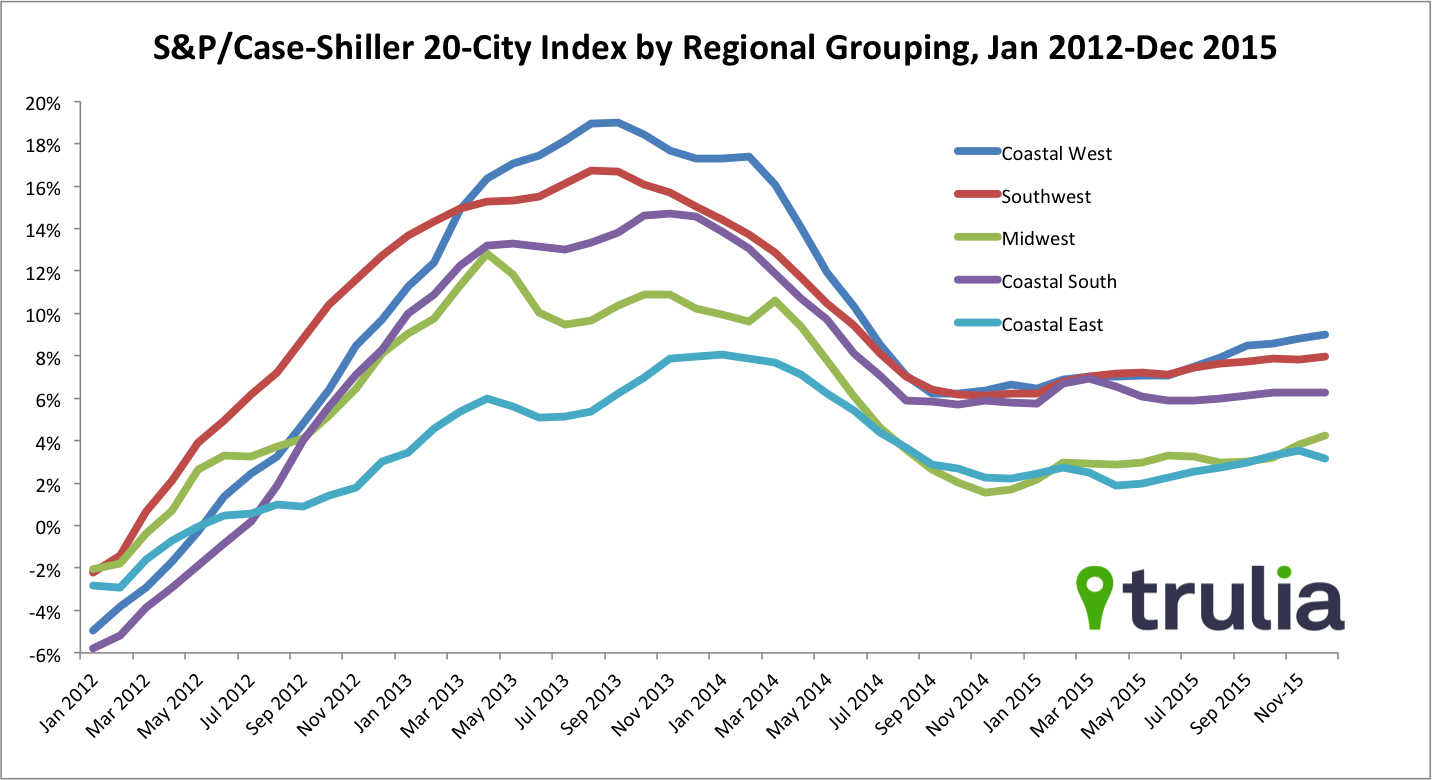

Prices in last month’s hot markets – San Francisco, Denver, and Portland – continue to lead the country. Portland topped the list with an 11.4% increase, while San Francisco and Denver grew by 10.3% and 10.2%, respectively. Higher prices in these markets should help increase inventory headed into 2016, but at the same time push some homes out of reach for buyers. When looking at regional groupings, prices in the coastal West, Southwest, and coastal South led the way with year-over-year average price increases of 9.0%, 8%, and 6.3%. Prices in the Midwest and coastal East lagged, showing smaller gains of 4.2% and 3.2%. This suggests continued widening of the price gap between coastal, temperate regions of the country and more inland, northeasterly markets.

Existing home sales stabilized in January after erratic month-over-month swings of -10.7% in November 2015 and +14.7% in December 2015. Though sales in January 2016 are up just 0.4% from December 2015, this modest increase is likely due exceptionally high levels of home sales in December. A large number of expected November homes sales spilled over into December because of delayed closings caused by TILA-RESPA “Know Before You Owe” lending regulations. This caused the normal volume in January to look comparatively small.

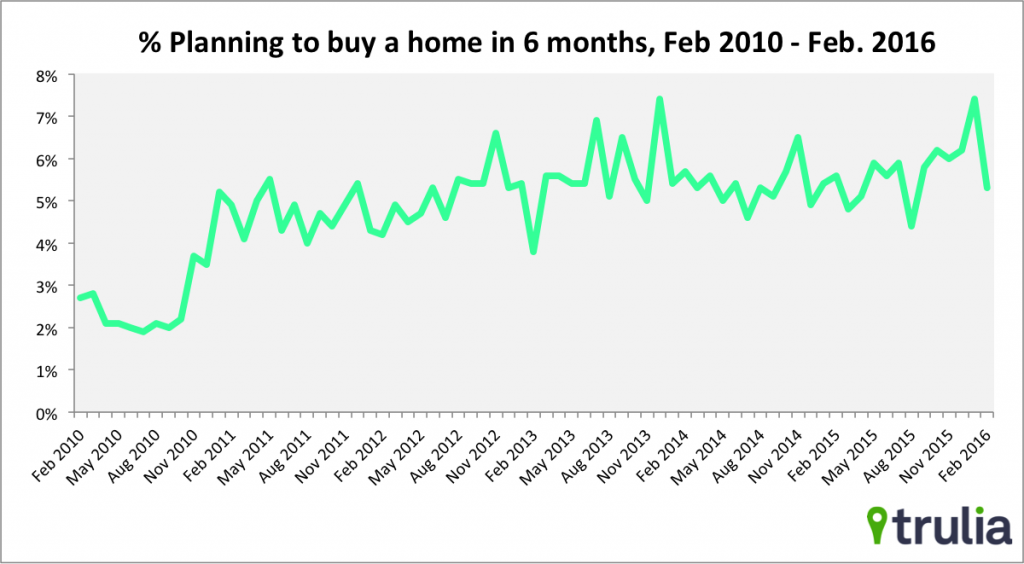

Last, the Consumer Confidence Index dropped substantially in February, likely reflecting consumers’ unease over global economic conditions and poor performance in U.S. stock markets. This drop in confidence also spilled over into the housing market: consumers planning on purchasing a home in the next six months decreased from a seasonally-adjusted 7.4% in January to 5.3% in February. This is a six-month low.

Today’s Highlights:

- The U.S. National index for November 2015 was up 5.4% year-over-year.

- The three cities with the largest year-over-year gains were Portland, San Francisco, and Denver, with gains of 11.4%, 10.3%, and 10.2%.

- Existing home sales in January normalize from a rocky November and December, climbing 0.4% month-over-month.

- The share of Americans looking to purchase a home in the next six months is at a six month low, at 5.3%.