- Home prices slowed slightly from last year, but homebuyers again face a challenging market as prices rose from March. With mortgage rates relatively unchanged, expect relentless demand to continue through spring’s home-buying season despite chronically low inventory and escalating prices.

- Seattle continues to remain hot with increases in home prices threatening to reach their highest point since the post-crisis peak in November 2013. Regionally, price changes are mixed, but all 20 cities saw year-over-year growth in prices to varying degrees, led by Seattle, Portland, Ore., and Dallas.

- Across the housing market existing and new home sales are held back by all-time lows in inventory, combining for an ultra-competitive market for homebuyers.

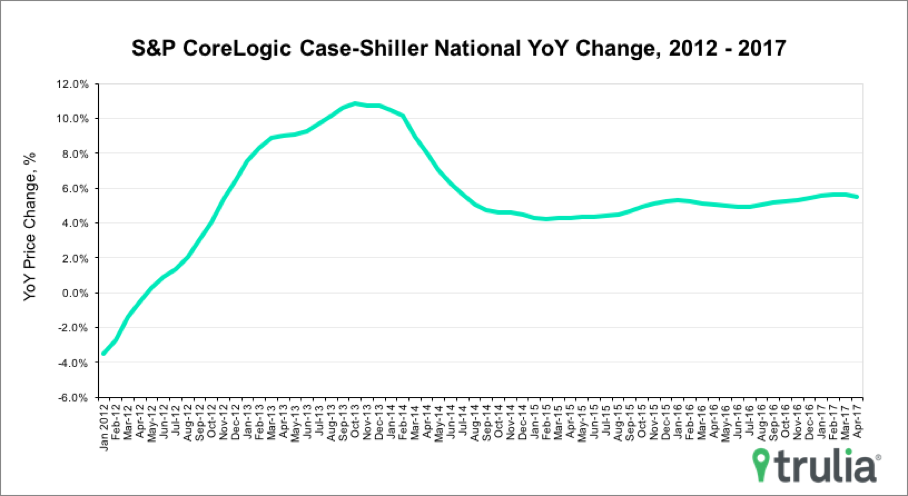

U.S. home prices rose lower than expected with today’s S&P CoreLogic Case-Shiller National Home Price Index. Low inventory and high demand pushed April’s index up 5.5% from last year, down slightly from a revised 5.6% year-over-year in March. Expect the index to track up through the spring buying season as mortgage rates remain relatively low and homebuyers remain undeterred despite facing a number of headwinds.

There appears to be some relief in home prices regionally as 13 of the 20 cities saw prices decrease in April before seasonal adjustment. Seattle, however, climbed to a double-digit annual rate of 12.9%, the highest annual increase since October 2013. Prices in Portland, Dallas, and Denver also continue to track above the national rate.