A few weeks ago, we worked with Bloomberg BusinessWeek to put together a list of the priciest homes sold in 2011. Lo and behold, the top three were bought by European billionaires (and their heiress daughters). Just see for your self:

1. Los Altos Hills Mansion

Sales Price: $100,000,000

Buyer: Yuri Milner, Russian tech billionaire

(Source: Google Maps image)

2. Central Park Penthouse

Sales Price: $88,000,000

Buyer: Ekaterina Rybolovleva, 22 year old daughter of Russian Billionaire Dmitriy Rybolovlev

(Source: Brown Harris Stevens)

3. Spelling Manor

Sales Price: $85,000,000

Buyer: Petra Ecclestone, 22 year old daughter of British billionaire Bernie Ecclestone

(Source: Google Maps image)

(HINT: To see more eye candy homes of the rich and famous, check out our sister blog, Trulia Luxe Living)

If you ask us, some people have way too much money to burn ’cause just thinking about the property tax for these homes is giving us heart burn! But honestly, it’s not that surprising. Last year, foreign homebuyers reportedly bought about $41 billion worth of homes on U.S. soil.[1] In fact, some experts have suggested that these buyers will help stabilize America’s housing market (though it will do little to bring about a full recovery).

America as Europe’s Piggy Bank

Now before we pin all our hopes on these international house hunters, we should probably take a closer look at what’s brewing across the pond. As you may have seen in the news, Europe is kind of a hot mess right now. How bad is bad? Well, let’s just say that Reuter’s finance reporter, Felix Salmon, has resorted to using Lego toys to explain what’s happening and why Europe’s financial mess is much worse ours – check out the video pasted below.

As for what really matters, we turned to our Chief Economist Jed Kolko (@jedkolko) for his thoughts on how Europe’s money woes will likely affect the U.S. housing market in 2012. Here’s what he had to say:

“As Europe’s financial crisis turns into a deeper recession, Europeans will spend less on nearly everything, including real estate. But for those Europeans who would still be in a position to invest, U.S. assets — including U.S. real estate — could turn out to be safer investments than European stocks, bonds or property.”

In other words, the financial crisis in Europe might actually encourage people to invest in U.S. real estate; however, it won’t be everyday Joe Shmoes trying buy a piece of the American Dream of homeownership. Instead, it’s going to be men and women of means looking for a safer place to store their money.

More Greeks Looking to Move (Their Money)

When we last looked at what the international house hunting community was up to, we found that most of the interest was coming from our neighbors up north (aka, the Canadians) and that Florida was the crowd favorite.

This time around, we decided to shine a spotlight on Europe in order to answer the billion dollar question – will Euros keep on flowing into the U.S. housing market or has that cash flow been capped?

To find out, we compared all the house hunting activity on Trulia.com that was coming from members of the European Union at the beginning of 2011 with what was happening at the end of the year. (And in case you were wondering, yes – we did our due diligence and normalized the data to make sure we’re looking at a genuine spike in interest). Next, we zeroed in on the top 10 Eurozone countries (aka the ones that use the Euro) that are doing most of the house hunting on Trulia.com and then ranked them based on who had the biggest spike in interest.

Where Interest in U.S. Real Estate Spiked Up or Dropped

| # | Country | 2011 Q1-to-Q4 % Change |

| 1 | Greece | 17.8% |

| 2 | Italy | 7.2% |

| 3 | Spain | 3.1% |

| 4 | France | -6.2% |

| 5 | Germany | -12.0% |

| 6 | Belgium | -14.3% |

| 7 | Austria | -14.4% |

| 8 | Finland | -15.7% |

| 9 | Ireland | -19.5% |

| 10 | Netherlands | -27.5% |

Well, well, well, so what do you know. Greece – which has often been referred to as the “patient zero” of the region’s current debt epidemic – came in first place with a 17.8% spike in interest. While there are probably a multitude of other contributing factors, this simple observation suggests that many of these Greek homebuyers aren’t just looking for a home away from home. Instead, they’re looking to take their money and fly the coop.

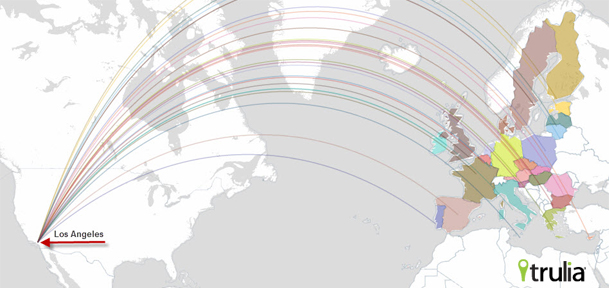

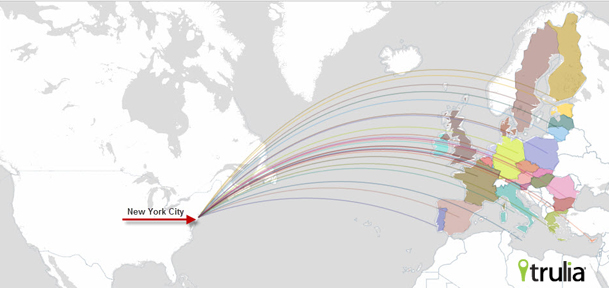

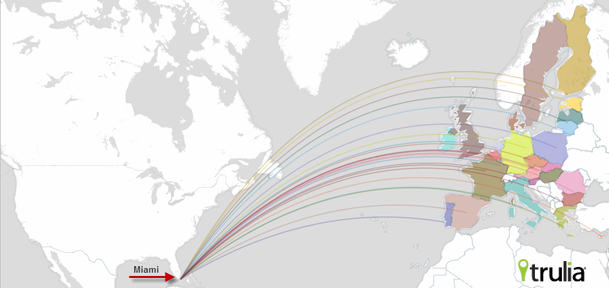

Making A Rainbow Connection

Just looking at the most popular U.S. metros being eyeballed by European house hunters will tell you that international cities (Los Angeles, New York and Miami) are on almost everyone’s top 10 lists.

Also, places with a TON of bargain bin homes are just as popular, if not more. Yes, we’re talking about you, Florida, Las Vegas and Phoenix, I mean, just look at the 20 most popular metro areas (as according to Europeans) – 10 of them are in one of these “sales rack” markets!

U.S. Metros Favored By European House Hunters

| # | U.S. Metros |

| 1 | Los Angeles, CA |

| 2 | New York, NY |

| 3 | Miami, FL |

| 4 | San Francisco, CA |

| 5 | Orlando, FL |

| 6 | Cape Coral, FL |

| 7 | Chicago, IL |

| 8 | Las Vegas, NV |

| 9 | Naples, FL |

| 10 | Fort Lauderdale, FL |

| 11 | Orange County, CA |

| 12 | West Palm Beach, FL |

| 13 | San Diego, CA |

| 14 | Washington, DC |

| 15 | Tampa, FL |

| 16 | Lakeland, FL |

| 17 | San Antonio, TX |

| 18 | Houston, TX |

| 19 | Atlanta, GA |

| 20 | Phoenix, AZ |

As for some of the other notable notables:

—–House hunters from the tiny island country of Cyprus have a thing for Michigan. Detroit, Warren and Kalamazoo made it on their top 10 list. Who knows, maybe Cypriots are just trying to find a home for sale on America’s only floating zip code (though highly unlikely as 48222 is just a 45-foot boat….now why does a boat have a zip code, you ask? Well, why not? What do you have against boats?!)

—–Austrians seem to be following in the footsteps of their former compatriot (us Californians know him as our ex-Governator, Arnold Schwartzenegger). Several Southern California cities made it on their top list, including Los Angeles, Orange County, San Diego and Riverside.

—–The Finns and Swedes – who live the furthest up north on the European continent – must be really be sick of the cold weather up there because they sure seem to love the homes in Florida. In addition to Miami, Cape Coral, Fort Lauderdale, Tampa, Naples and West Palm Beach also made it onto their top 10 lists.

[1] National Association of Realtors, April 2011