This year’s home-buying season looks nothing like last year’s. With mortgage rates and home prices rising, the best deals are long gone. Furthermore, there are fewer homes for sale now than one year ago. To what lengths will desperate house hunters go to snag the house of their dreams, and what are they most worried about? To get the answers to these questions, Trulia worked with Harris Interactive to conduct an online survey of 2,029 U.S. adults between June 24-26, 2013. For the full methodology, see below.

What Prospective Home Buyers Worry About

Prospective home buyers are feeling the pain of a booming real estate market. The top worry among all survey respondents who might buy a home someday is that mortgage rates will rise further before they buy (41%), followed by rising prices (37%).

In the hottest markets – those where asking home prices rose more than 15% year-over-year like Las Vegas and Oakland – buyers’ worries are even more intense. In those areas, potential house hunters have heightened concerns about continued price increases, competition from other buyers, and having to decide quickly on a home before it gets snapped up. The only thing that people in the hottest markets worry about less than people in the rest of the country is qualifying for a mortgage.

While rising mortgage rates are the top concern for people if they were to buy a home within the next year, people actually planning to buy within the next year have another main worry: finding a home they like. Tight inventory means slim pickings for buyers. Even though inventory is starting to expand, and rising home prices should bring more for-sale homes onto the market, people who actually want to buy within the next year are feeling the pressure of competing buyers and limited inventory.

|

House Hunting Worries |

|||

|

Overall |

In hottest markets |

Planning to buy in next 12 months |

|

| Mortgage interest rates would rise before I buy |

41% |

45% |

43% |

| Home prices would rise before I buy |

37% |

42% |

38% |

| I would not find a home for sale that I like |

36% |

38% |

43% |

| I would not qualify for a mortgage |

30% |

25% |

25% |

| I would have to compete with many other buyers for the home I wanted most |

27% |

33% |

32% |

| Home prices would fall after I buy |

25% |

30% |

21% |

| I would have to decide on a home very quickly because homes for sale are not staying on the market for long |

19% |

26% |

30% |

| Note: only among respondents who plan to buy a home someday. Hottest markets are metros where prices increased more than 15% year-over-year in June according to the Trulia Price Monitor. Exact survey question: “if you were to buy a home this year, in 2013, which of the following, if any, would be among the things that you would worry most about?” | |||

Desperate Times Call For Desperate Measures

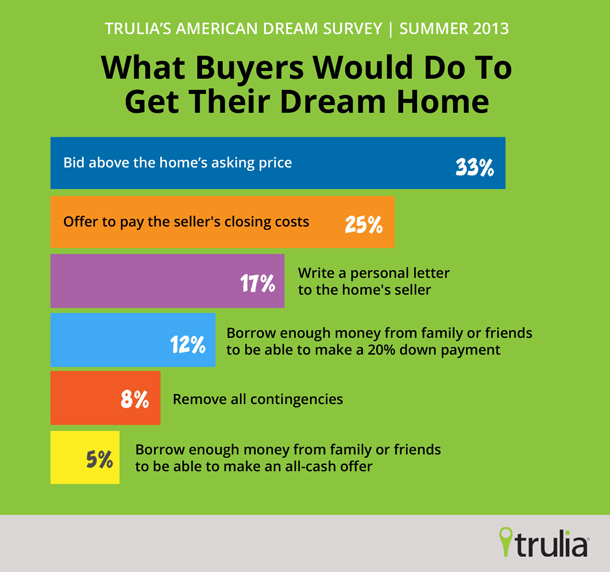

With all these worries, home buyers are willing to do a lot to get the home of their dreams. In fact, among survey respondents who plan to buy a home someday, 2 in 3 (66%) would use aggressive tactics such as bidding above asking, writing personal letters to the seller, or removing contingencies, to name a few. One in four (25%) would be willing to pay the seller’s closing costs, and 25% would also be willing to bid 1-5% over asking. However, people would sooner write a personal letter to the seller than bid 6-10% or more than 10% above the asking price.

Delving deeper, we find that richer and poorer households would try different tactics to land the home their heart is set on. Households earning more than $100,000 a year are more likely to buy their way into their dream home than lower-income households. Specifically, they’re willing to pay the seller’s closing costs or bid 1-5% or 6-10% above asking. On the flip side, households earning under $50,000 a year are more likely than richer households to borrow from family and friends in order to put down 20% or even make an all-cash offer.

But watch out if you’re competing for a home against Millennials. Young adults are more likely to try every tactic we asked about, including bidding above asking, borrowing money from family and friends, and especially writing letters. Maybe the young have more faith in the power of persuasion – or perhaps older adults, who are more likely to have been through the home-buying process before, think that talk is cheap.

|

What Buyers Would Do To Get Their Dream Home |

||||

|

Tactic |

Overall |

Income > $100k |

Income < $50k |

18-34 Year Olds |

| Offer to pay the seller’s closing costs |

25% |

30% |

25% |

30% |

| Bid 1-5% over the home’s asking price |

25% |

30% |

19% |

31% |

| Write a personal letter to the home’s seller |

17% |

17% |

15% |

23% |

| Borrow enough money from family or friends to be able to make a 20% down payment |

12% |

10% |

14% |

19% |

| Bid 6-10% over the home’s asking price |

9% |

12% |

8% |

12% |

| Remove all contingencies |

8% |

7% |

8% |

9% |

| Borrow enough money from family or friends to be able to make an all-cash offer |

5% |

4% |

7% |

8% |

| Bid more than 10% over the home’s asking price |

4% |

4% |

4% |

7% |

| I would not do anything to increase the chances of my offer being accepted |

34% |

28% |

36% |

22% |

| Note: only among respondents who plan to buy a home someday. Exact question wording: “If your heart was set on buying a specific home, which of the following, if any, would you do to increase your chances of having your offer accepted?” | ||||

Smaller Dreams Today, Bigger Payoffs Tomorrow

Let’s set aside immediate worries and take a longer view: how is the recovery changing how Americans feel about homeownership? It turns out that the recovery cuts both ways. Homeownership is becoming less affordable and therefore less within reach, but rising prices have encouraged consumers to see homeownership as a better long-term investment. That means Americans have smaller dreams today, but expect bigger payoffs tomorrow.

First, smaller dreams: the share of Americans who say that homeownership is part of their personal American Dream dropped from 72% in November 2012 to 67% in June 2013. Furthermore, among people who said homeownership was part of their personal American Dream, their ideal home size has shrunk. In June 2013, 7% of Americans said their ideal home size was 3,200 square feet or larger, down from 11% in May 2012. Rising home prices and mortgage rates have each increased the cost of homeownership by more than 10%, so owning is now more than 20% pricier than it was a year ago. Relative to then, fewer people can afford to buy a big house – or any house at all.

|

Downsizing the American Dream Home |

||

| Ideal Home Size

(Square Feet) |

June 2013 | May 2012 |

| 800 to 1,400 | 10% | 8% |

| 1,401 to 2,000 | 31% | 29% |

| 2,001 to 2,600 | 26% | 25% |

| 2,601 to 3,200 | 15% | 16% |

| More than 3,200 | 7% | 11% |

| Note: among respondents who said homeownership was part of their personal American Dream. | ||

However, Americans think housing is a much better investment now than two years ago (we last asked this question in August/September 2011). Then, 47% of consumers thought that owning a home was one of the best long-term investments they could make; now, 60% do. Owning a home ranks slightly ahead of retirement accounts like 401(k)s and far ahead of the stock market. In fact, Americans today believe homeownership, retirement accounts, and stocks are much better long-term investments than two years ago, but the increase for homeownership was particularly large. Millennials, especially, have become more bullish on housing as an investment: 59% of 18-34 year-olds think housing is one of the best long-term investments they can make, compared with just 40% in 2011 – a much bigger leap than for any other age group.

|

What Respondents Think Are the Best Long-Term Investments |

||

|

June 2013 |

Aug/Sept 2011 |

|

| Owning a home |

60% |

47% |

| Putting money away in a 401(k) or other retirement account |

57% |

48% |

| Investing in the stock market |

28% |

22% |

| Purchasing mutual funds |

25% |

24% |

| Buying gold |

18% |

23% |

| Buying government bonds |

12% |

14% |

| Keeping cash under the mattress |

10% |

10% |

The housing recovery has clearly changed Americans’ view of housing and homeownership. Rising prices and mortgage rates have forced Americans to downsize their real estate dreams, while determined buyers have multiple worries and are prepared to take desperate measures to buy a home in today’s competitive market. So why do they bother? Because they believe the long-term financial payoff looks a lot better now than two years ago, before prices started their rebound.

Full Methodology

This survey was conducted online within the United States between June 24-26, 2013 among 2,029 adults (aged 18 and over), by Harris Interactive on behalf of Trulia via its Quick Query omnibus product. Figures for age, sex, race/ethnicity, education, region and household income were weighted where necessary to bring them into line with their actual proportions in the population.

All sample surveys and polls, whether or not they use probability sampling, are subject to multiple sources of error which are most often not possible to quantify or estimate, including sampling error, coverage error, error associated with nonresponse, error associated with question wording and response options, and post-survey weighting and adjustments. Therefore, Harris Interactive avoids the words “margin of error” as they are misleading. All that can be calculated are different possible sampling errors with different probabilities for pure, unweighted, random samples with 100% response rates. These are only theoretical because no published polls come close to this ideal.

Respondents for this survey were selected from among those who have agreed to participate in Harris Interactive surveys. The data have been weighted to reflect the composition of the adult population. Because the sample is based on those who agreed to participate in the Harris Interactive panel, no estimates of theoretical sampling error can be calculated.