With home prices on the rise across the county and inventory at historic lows, homeownership is even more out of reach for many middle-income Americans. Nationally, the typical American worker makes $37,040 annually (national median income) while the typical American house costs $254,900 (national median list price). That means that the median worker would have to spend 42% of their income on mortgage payments if they bought a median-priced home, up six percentage points from two years ago.

However, medians don’t tell the whole story. To shed light on how unaffordable housing has become across the country today, Trulia examined the incomes of teachers, first responders, restaurant workers and doctors in nearly 100 major U.S. metros to see where people are struggling to afford to buy a home in the communities they serve.

Using the latest median wage data for each occupation[1] from the Bureau of Labor Statistics recently-released May 2016 Occupational Employment Statistics report, we calculated the share of homes for sale in each market that are affordable to each category of worker. We define affordability as having a debt-to-income ratio at 31%, which means one’s monthly payment on housing would only take up 31% of one’s paycheck. We assume that borrowers can put down a 20% down payment for a 30-year fixed rate mortgage at a 4.1% interest rate. We also include any homeowners association fees on the property, property tax and insurance into the affordability calculation.

Our analysis found:

- Restaurant workers faced the greatest challenges to affording a home. Receiving the lowest reported wages among the occupations examined, which hovered just above $20,000 a year, restaurant workers could afford less than 10% of the available homes in 56 of 93 major metros.

- Seven of least affordable markets for teachers were in the coastal California metros such as San Francisco, Los Angeles and San Diego. Austin, Texas, Denver, and Honolulu round out the top 10. Where a teacher’s salary goes furthest was in the Rust Belt where teachers could afford at least 75% of for-sale homes in Dayton, Ohio, Akron, Ohio, Detroit, El Paso, Texas, Syracuse, N.Y., Little Rock, Ark. and Toledo, Ohio.

- Beyond the San Francisco Bay Area, first responders, such as police officers and firefighters struggle to find homes they can afford in high priced Southern California markets of Orange County, Calif. and San Diego. Less expensive markets where first responders are paid less, such as Raleigh, N.C., Madison, Wis. and Nashville also pose challenges to home buying.

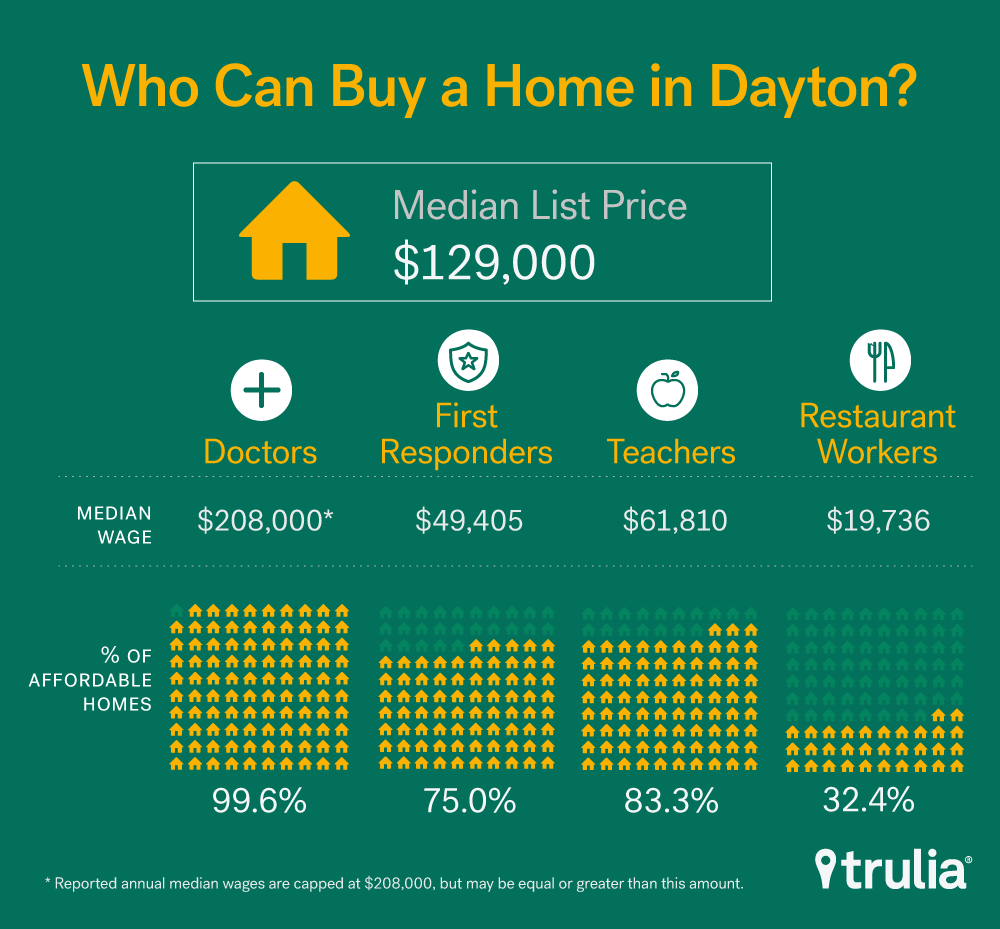

- Doctors,[2] the highest wage earners of any group examined here, find at least 50% of the housing in each market affordable in all but San Francisco where this percentage is just 41.57%. In Dayton, Ohio, Toledo, Ohio, El Paso, Texas, Columbia, S.C. and Little Rock, Ark., doctors get their pick of the lot as they can afford to buy 99% of listed homes.

Middle America: Teachers and First Responders Can Live Where They Work

At the other end of the spectrum, Dayton, Ohio appeared in the top 10 list of most affordable housing markets for each of the occupations analyzed. Restaurant workers can afford nearly a third of the homes for sale. Meanwhile, teachers, first responders and doctors could buy most of the homes on the market as 83.3%, 75.0% and 99.6% of homes are affordable to workers in these occupations, respectively.

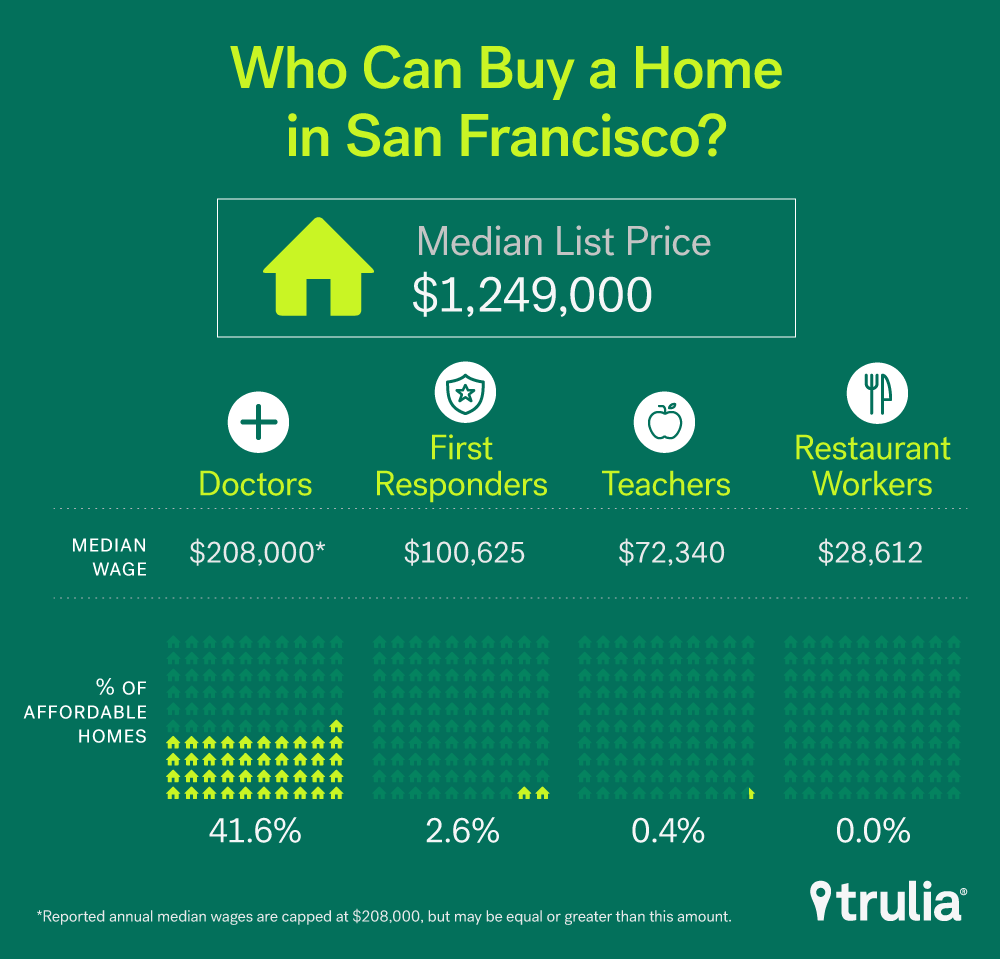

However, housing markets with relatively low home prices may not always be the most affordable places to live if wages are also relatively low. Raleigh and Madison, Wis. have median listing prices in the low $300,000s, just above the national median listing price, but wages for first responders are some of the lowest for these metros. As a result, Raleigh and Madison are two of the least affordable markets for police officers and firefighters. Likewise, relatively high wages for an occupation may not be enough to afford the most expensive markets. First responders earn the most in San Francisco at just over $100,000 a year, but this is only enough to afford 2.6% of homes currently on the market.

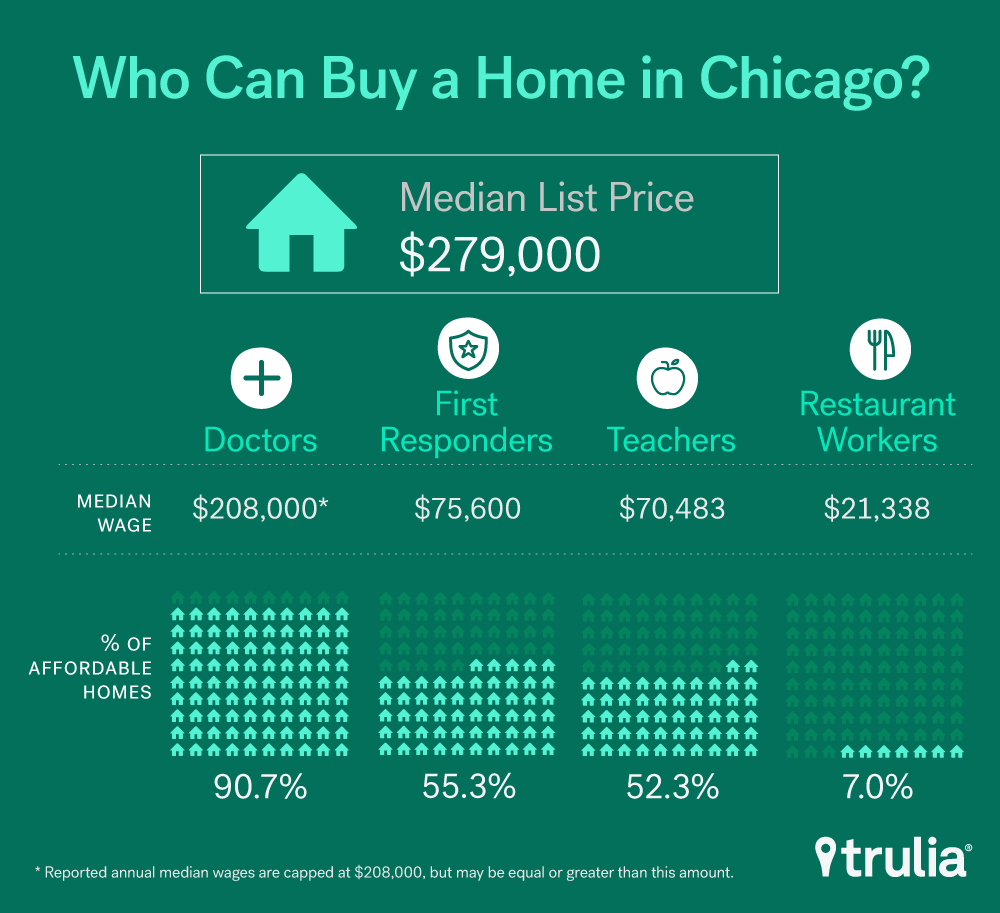

In the middle of the affordability spectrum are markets like Chicago, where the median listing price for a home is slightly above the national median. Following the trend nationally, restaurant workers and doctors are able to afford the least and most homes in the market, respectively. However, teachers and first responders can afford nearly half of homes at 52.3% and 55.3% each.

Even Doctors Are Getting Priced Out of San Francisco Bay Area

San Francisco and San Jose, Calif. occupied two of the top three spots in terms of least affordable housing markets for each occupation we examined. This came as no surprise since both metros boasted the highest median listing prices in the country at $1.25 million and $917,903, respectively. Restaurant workers couldn’t afford any of the currently listed homes in these markets. Meanwhile, teachers and first responders could only afford less than 10% of homes. Doctors fared better, but could only afford 41.6% and 56.9% of homes, respectively.

While large shares of available homes remain unaffordable to teachers, first responders, and restaurant workers in some the nation’s biggest markets there are pockets of affordability in even the most expensive metros. In the East Bay in the San Francisco Bay Area, or the Oakland metro area, 8.2% of homes are affordable to teachers. Many of these homes are located in Bay Area cities such as Antioch, Hayward and Union City. Meanwhile, first responders and doctors have even more options with 24.3% and 76.0% of the market affordable, respectively.

Affordability Pressures Reduced for Two-Income Households—Mostly

We started this analysis by looking at the share of affordable homes for one-income households for each occupations, but we know this doesn’t paint a complete picture of affordability. Many households have two-income earners, and thereby have more buying power.

When we calculated affordability for two-income households in the same occupation, we see that the pressure of finding an affordable home on the market is reduced—mostly. For first responders, doubling income ensures at least 50% of homes on the market are affordable to these households in all markets except in costly San Francisco. Two-income teacher households, however, still feel the crunch in San Francisco, San Jose, Calif., and Honolulu where less than 50% of available homes in these markets are within reach. Meanwhile, the number of markets where restaurant workers can afford less than 10% of listed homes drops to 12 from 56 by adding an additional income. However, two-income restaurant worker households still face acute affordability challenges in their home markets.

For this report, we only looked at the numbers for four occupations in major metros. Using this same affordability calculation, home shoppers anywhere can estimate how much home they can afford based on where they want to live with Trulia’s Affordability Calculator. Assumptions about incomes, down payments and other debts can be adjusted accordingly. It’s a great starting point for all serious buyers – at all income levels – who are starting their homes search.

Methodology

Affordability is defined as spending 31% or less of one’s monthly income on housing. In order to find the share of affordable homes on the market for the median income earner for each occupation we calculate the maximum amount that each person can allocate towards a mortgage payment based on their wage. Evaluating the listing price of each home effective April 2, 2017 minus a 20% down payment and calculating the monthly mortgage payment using the prevailing 30-year mortgage rate at that time of 4.1% in the markets we examine along with any HOA fees, mortgage insurance and property taxes we sum the number of listed properties that the median income earner for each occupation could afford.

[1] A number of occupations include multiple sub-categories and in these cases, the average of the median incomes were reported as the annual income. For example, teachers here include elementary, middle, and secondary school teachers (not including special education). Restaurant workers here include restaurant cooks, food preparation workers, bartenders and waiters and waitresses. First responders include police and sheriff’s patrol officers and firefighters.

[2] Annual median income that exceeds $208,000 is not reported. For doctors, there were 24 markets where doctors made at least $208,000 so we imputed that amount but can assume in some places doctors could make significantly more, impacting the share of homes they would be able to afford.