Maybe you’ve heard, it’s tough out there for American homebuyer. Inventory is low, prices are high and rising, and the quality of starter homes especially is on the wane.

But there’s another “there:” out there. For as much as we hear about runaway, unaffordable markets such as San Francisco, Seattle and Washington, some home prices in many markets have remained flat during the last year – even fallen.

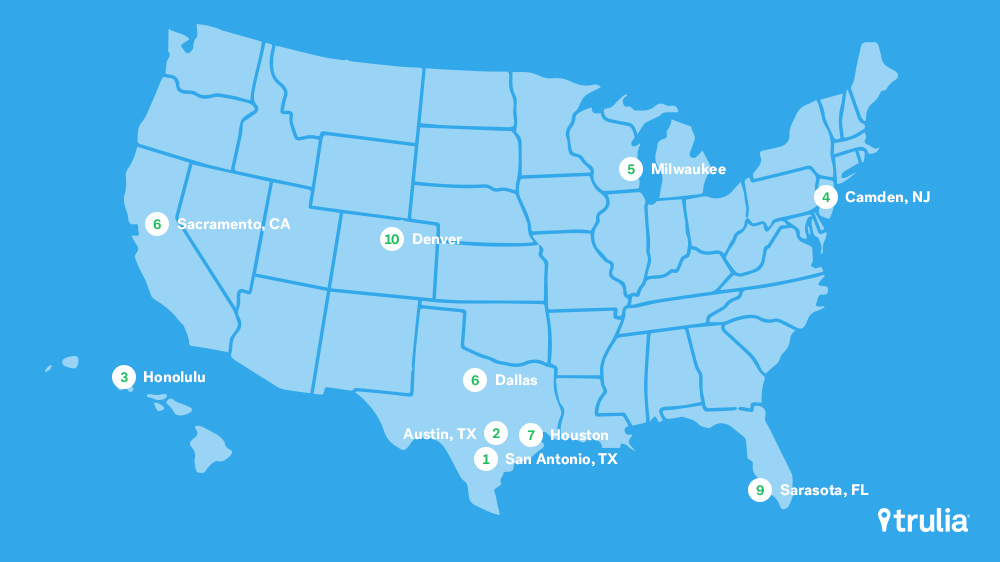

And the list might surprise you. Places like Austin, Texas, Sacramento, Calif., and Denver make up the top 10 places where median listing prices either stalled or fallen. In this report, using information culled from our Data Central feature, we identify these cool markets and give some context around the sluggish price performance.

And just a caveat: listing prices only examine what’s on the market compared to a year ago. Home value estimates, which will be discussed in some markets, are another indicator of a housing market’s strength. So, for instance, a market may see cheaper listings because newer cheaper homes have been built, but overall home values may still be rising.

1. San Antonio, Texas

San Antonio’s job growth outpaced the national average 4.2% to 1.7%. So what gives? Could be wages, they fell 2.6% from a year earlier. Or, it may just be that cheaper homes have hit the market. We estimate that median home values rose 9.4% in the last 12 months – that’s more than the 8% national median home value.

2. Austin, Texas

Like many cities in Texas, Austin is undergoing a housing boom to match an economic boom. The market has seen 6% job growth compared to 1.7% nationally and it’s unemployment rate is just 3% compared to 4.4% nationally. Last year Austin issued 79.5% more building permits than its historic average, 40% of them high density, ranking second among the nation’s biggest housing markets.

3. Honolulu

Honolulu is the most expensive market on our list, and it’s a traditionally hot housing market in boom times. That said, it appears Honolulu has stabilized. The estimated median home value rose only 7.5%. And the home listed for sale? They’re about $40,000 less than the value of the median home (by estimated value) in the market. And this despite wages rising 5.6%, nearly double the national average.

4. Camden, N.J.

Unlike some of the other markets on our list, Camden’s flat housing prices reflect its flat economy. Employment fell 0.6% in the last year and the unemployment rate is 4.8%, higher than the national average. The overall housing market is stable, but not growing much. Home values are up a little less than 2%.

5. Milwaukee

The only Midwest market to make our list, Milwaukee typifies the solid markets found there – impervious to booms and busts. Employment is strong in the area. The unemployment rate is a scant 3.2% and the region has seen 4.5% job growth in the last year. Wages are up too, 6.7%, compared to 2.9% nationally.

6. Sacramento, Calif.

Roughly 100 miles from the supercharged San Francisco Bay Area market, Sacramento is a stable, if still expensive neighbor. With wages rising 5.1%, an unemployment rate around the national average and job growth, 2.7%, slightly above the national average, Sacramento has a strong economy. Overall home values have risen 12.1% in the last year, suggesting that there’s more cheap housing on the market now.

7. Houston

Flood ravaged and it’s housing stock deeply damaged, Houston is building, building, building. Houston ranked second nationally in terms of building permits issued last year with more than 42,000 and most of that was before Hurricane Harvey flooded and ruined many homes. Houston is clearly a market in transition. Federally funded rebuilding efforts and many residents still displaced make it a market to watch.

8. Dallas

Dallas is the leader when it comes to the Texas building boom. It approved more than 47,000 permits last year. The market has seen 3.8% job growth, 3.2% wage growth and its unemployment rate is 3.7%. They are strong economic numbers for sure, but Dallas’ willingness to build is offsetting any demand pressure in the market. Median home values rose 15%, suggesting that much of the new housing is cheaper.

9. Sarasota, Fla.

Sarasota looks to be a stable market. Median home values are up 7.5% roughly around the national average as measured by Case Shiller. Sarasota job growth is 2.5%, its wage growth is 3.5%, and its unemployment rate is 3.5%.

10. Denver

Denver home values are up 11.2%. But new housing appears to be the key here for this town with low unemployment, better-than-average wage growth and strong job growth. Denver issued more than 22,000 building permits last year, 40% more than its historical average.

Median Listing Price Changes 1-year Change, 100 Biggest Housing Markets

Note: Some wage data is not available

Methodology

Median listing price, price per square foot, home value, and home value per square foot were pulled for March 2018 and compared with March 2017 for year-over-year comparisons.

Local Area Unemployment Statistics (LAUS) data on employment counts and the unemployment rate from the Bureau of Labor Statistics for the month of February 2018 was compared with February 2017 for the year-over-year comparison. Nonfarm payroll data was used for the same months for wages.