SAN FRANCISCO, Dec. 20, 2018 /PRNewswire/ — The number of homes for sale nationwide tumbled 4.6 percent year-over-year in the last three months of 2018 across all price categories, according to the latest Inventory and Price Watch Report from Trulia®, a home and neighborhood site for homebuyers and renters. This marks the ninth consecutive quarter of declining inventory; the last time inventory rose was in Q3 2016. However, there are signs of progress with the nation’s most expensive housing markets seeing large inventory gains.

Buyers Face Tighter Inventory and Worsening Affordability Heading Into 2019

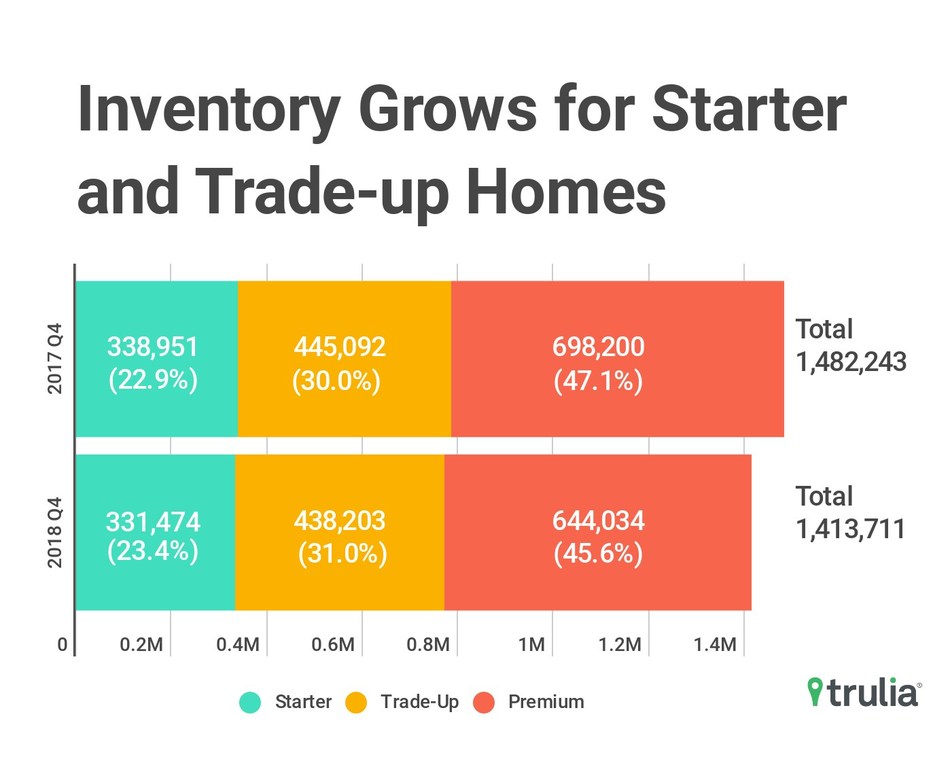

The drop in inventory is largely driven by the premium home segment where the number of for-sale homes fell 7.8 percent year-over-year (YoY), followed by modest declines across starter (2.2 percent) and trade-up homes (1.5 percent). Meanwhile, affordability has worsened across all housing segments as tight inventory and slow wage growth continues to put upward pressure on home prices. Nationally, starter home prices rose the most, up 13.9 percent from the last year. As a result, a typical starter-home buyer must now spend 41 percent of their income on a monthly mortgage payment, up from 34.2 percent a year ago.

|

2018 Q4 National Inventory and Price Watch |

||||||||

|

2018 Q4 |

Change, 2017 Q4 – 2018 Q4 |

|||||||

|

Housing Segment |

Median List Price |

Share of Total |

Inventory |

% of Income Needed to Buy Median Priced Home in Segment |

% Change in Median List Price |

Percentage Point Change in Share |

% Change in Inventory |

Additional Share of Income Needed to Buy a Home (Percentage Point Change) |

|

Starter |

$139,500 |

23% |

331,474 |

41.0% |

13.9% |

0.6% |

-2.2% |

6.8% |

|

Trade-Up |

$245,000 |

31% |

438,203 |

25.9% |

8.9% |

1.0% |

-1.5% |

3.3% |

|

Premium |

$460,000 |

46% |

644,034 |

21.9% |

5.7% |

-1.5% |

-7.8% |

2.2% |

“After promising signs of slowing inventory declines last quarter, the news is mixed as we close out 2018,” said Cheryl Young, senior economist, Trulia. “While more sellers are listing homes in expensive West Coast markets, most homebuyers must still contend with tight inventory that’s down 24 percent from five years ago. Coupled with slow wage growth, prices continue to inch higher, worsening affordability within the starter home market and possibly putting homeownership out of reach for many first-time buyers.”

Starter and Trade-Up Home Inventory Surges in Pricey California Markets

Housing markets in the West experienced the nation’s largest inventory gains despite the large dip in supply. Among the 100 largest U.S. metros, six of the markets with the biggest surge in inventory from last year were in California, most notably in San Jose (66.6 percent), San Francisco (36.5 percent) and Oakland (29.2 percent). This surge in every market except New York was driven by growth in starter and trade-up homes. In fact, the number of starter and trade-up homes in San Jose almost doubled from a year ago.

|

Where Housing Inventory Rose Most in 2018 |

||||

|

U.S. Metro |

Starter Home Inventory YoY |

Trade-up Home Inventory YoY |

Premium Home Inventory YoY |

Total For-Sale Home Inventory YoY |

|

San Jose, CA |

91.4% |

80.7% |

25.3% |

66.6% |

|

Salt Lake City, UT |

84.1% |

39.6% |

28.3% |

45.3% |

|

San Francisco, CA |

48.6% |

54.6% |

16.6% |

36.5% |

|

Seattle, WA |

14.1% |

62.8% |

26.3% |

32.3% |

|

Oakland, CA |

35.9% |

37.6% |

11.1% |

29.2% |

|

Colorado Springs, CO |

37.6% |

77.7% |

6.5% |

28.0% |

|

Orange County, CA |

44.3% |

36.1% |

16.1% |

27.7% |

|

San Diego, CA |

28.0% |

46.8% |

17.1% |

27.6% |

|

Los Angeles, CA |

31.7% |

21.7% |

19.6% |

23.5% |

|

New York, NY |

12.2% |

16.7% |

20.4% |

16.9% |

Starter Home Affordability Continues to Worsen

Despite inventory gains in the most expensive housing markets, prices continue to rise and outpace wage growth – especially in the starter home category. This has further put homeownership out of reach for many first-time buyers. For example, a typical starter-home buyer in San Francisco where the median starter home lists for nearly $900,000, would need to spend an unrealistic 146.9 percent of their income to afford a home.

|

Where Starter Affordability Worsened Most in 2018 |

|||

|

U.S. Metro |

Starter Home Price |

Starter Household Income |

Starter Home Affordability (YoY) |

|

San Francisco, CA |

$895,000 |

$35,425 |

146.9% (+23.2%) |

|

San Jose, CA |

$759,250 |

$38,645 |

115.8% (+19.3%) |

|

Oakland, CA |

$485,000 |

$33,278 |

89.0% (+12.7%) |

|

Los Angeles, CA |

$399,950 |

$22,328 |

106.9% (+11.4%) |

|

Miami, FL |

$185,000 |

$17,952 |

71.8% (+10.9%) |

|

Fresno, CA |

$164,900 |

$17,250 |

61.0% (+10.0%) |

|

Newark, NJ |

$209,000 |

$27,560 |

56.8% (+9.7%) |

|

New York, NY |

$254,800 |

$21,412 |

78.0% (+9.5%) |

|

Las Vegas, NV |

$179,900 |

$23,458 |

47.5% (+9.5%) |

|

Orange County, CA |

$495,000 |

$34,351 |

85.7% (+9.0%) |

Methodology

The Trulia Inventory and Price Watch offers buyers and sellers deeper insight into the change in supply and affordability of homes, within three different segments of the market: starter homes, trade-up homes, and premium homes. Based on the for-sale homes listed on Trulia, this report calculates housing inventory within each segment nationally and in the 100 largest U.S. metros, from October 1 to December 1, 2018. For the full report and methodology, see here.

About Trulia

Trulia’s mission is to build a more neighborly world by helping you discover a place you’ll love to live. Homebuyers and renters use Trulia’s website and suite of mobile apps to get a deeper understanding of homes and neighborhoods across the U.S. through personalized recommendations, insights sourced straight from locals, and 34 neighborhood map overlays that offer details on commute, reported crime, schools, nearby businesses, and more. Founded in 2005, Trulia is based in San Francisco, and owned and operated by Zillow Group, Inc. (NASDAQ: Z and ZG). Trulia is a registered trademark of Trulia, LLC.

Media Contact:

pr@trulia.com

SOURCE Trulia

Related Links